Content

Margin demonstrates the relationship between gross profit on a sale and revenue. Revenue represents the total income gained from the sale, and gross profit refers to the profit that a business makes after subtracting the cost of goods sold. You can calculate your markup percentage by dividing markup in dollars Markup vs Margin by cost price in dollars, then multiplying by 100. The confusion stems from two concepts that are quite alike but represent two different components of accounting. Markup is used to set prices, and margin is used to evaluate performance. They try to present a different perspective on the same financial status.

- MarkupThe percentage of profits derived over the cost price of the product sold is known as markup.

- She learns that when she places a 25% markup on her tote bags, it results in a 20% profit margin percentage.

- Deciding the markup percentage is a complicated step and depends on a variety of factors like the manufacturing/sourcing price, product quality, and competition.

- You have a hundred different types of products and a mark up from 10%-100% in them.

- For example a markup of $90 on a product that costs $110 would give a selling price of $200.

Confusing profit margin vs. markup can lead to accounting and sales errors. For example, you might end up either under- or overpricing your products, which can cut away into your profits. Understanding the two terms is essential to know if you’re pricing your products most effectively. The cards should also define the difference between the margin and markup terms, and show examples of how margin and markup calculations are derived.

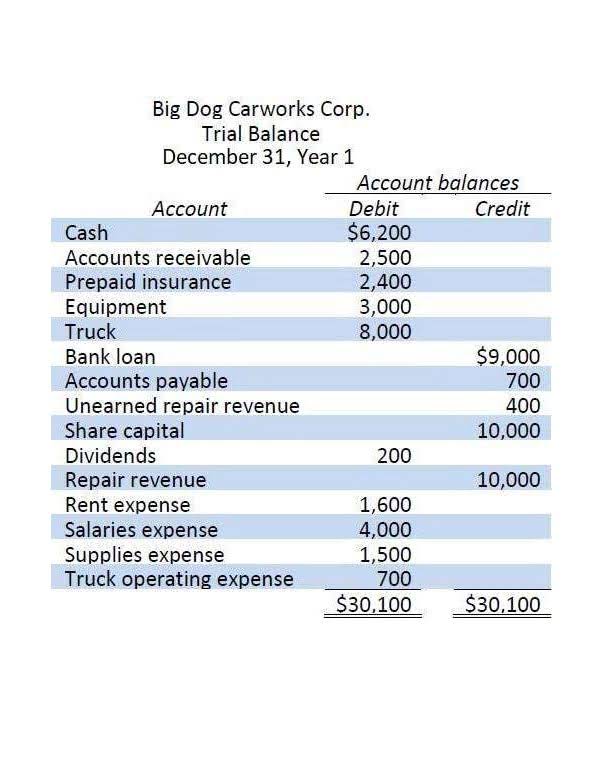

Margin Vs Markup Chart

Failing to understand the difference between the financial impact of using margin vs. markup to set prices can lead to serious financial consequences. In the example above, if Steve were to assume his 20% markup would yield a 20% margin, his net income would actually be 3.3% less than expected. While a 3.3% difference in net income may not seem like much, to many low-profit-margin businesses it can mean the difference between solvency or bankruptcy. If a 25% gross margin percentage is required, the selling price would be $133.33, making the markup rate 33.3%. It is easy to see where a person could get into trouble deriving prices if there is confusion about the meaning of margins and markups.

- One of the most important things you’ll do is a business owner is set pricing for your products and services.

- This does not reflect gross profit, but the difference between cost price and selling price.

- The gross margin ratio is 20%, which is the gross profit or gross margin of $2 divided by the selling price of $10.

- From the seller’s view, the $ 100 value is a margin, but when viewed from a buyer’s viewpoint, the same $100 is markup.

Since a product’s markup is higher than its margin, mistaking the two can be quite costly. If you accidentally markup the price based on margin, you’ll be pricing products too low.

Is There A Difference Between Profit And Margin?

Certain industries are known for having average markups that few businesses go outside of, so calculating this number can help you compete. If you don’t know your margins and markups, you might not know how to price a product or service correctly.

Markup is the amount by which the cost of a product is increased to determine a selling price. https://www.bookstime.com/ A markup of $40 on a product with a cost price of $60 cost yields a $100 selling price.

From this, we can say that margin is a measure of how much of every dollar earned in revenue is kept by the company after deducting expenses. This means that 50% of the total revenue is kept by the company, while the other 50% of revenue covers the cost of producing the headphones. Alternatively, you can express the margin as a percentage as by multiplying the figure above by 100. In this article, we are going to explain the difference between margin and mark up and explain why it is important to tell each apart from the other. I cannot count the number of times I have heard someone use the words markup and margin interchangeably.

Calculating Markup Percentage

To calculate your margin, calculate your profit by removing the cost price of an item from the revenue price you sold it for. Both margin and markup provide useful information for your business, with each calculation offering a different perspective, which is why it’s useful to calculate both. So make sure that the selling price of your product at least covers the operational costs of your business. If you want to calculate your markup percentage, then divide the markup amount by the cost of the product and multiply the result by 100.

- There is a majordifference between the two methods and their impact on your bottom line.

- In contrast, margin is the percentage difference between the selling price and the profit.

- Always look at the net profit margin the business generates for a clearer picture of where the company stands financially.

- In other words, whereas you divide the gross profit by revenue to calculate margin, you have to divide the gross profit by the COGS to determine the markup.

- To achieve a certain profit, you should use the markup percentage as in the example below.

- If one is not aware of the margins and markup formula, they can’t estimate the prices and cost of goods sold correctly, which will lead to losing out in profits.

So, there is not a standard difference between markup and margin. As your margin grows, the markup increases at an even greater rate. Choosing your markup is more complex than simply pricing your products to make a profit. Markup and margin are used in many businesses, and it’s essential to understand the difference in order to run a business successfully. Calculating your margin and markup allows you to make informed decisions to establish pricing and maximize profits. Knowing the difference between markup vs margin is key to avoiding a costly mistake and will ensure you can meet customer demand.

When determining management efficiency, gross profit margin is one of the more useful metrics a business owner can use. This offers consistency in creating a comparative amount of money regardless of the costs of your products, whether up or down. The higher the markup the higher the price, this can be applied across various services or products. Simply, a markup is the amount added on to the base cost of a product or service to make a profit. Putting a markup on your product or service means that you make a profit on sales, by selling it a higher price than what it cost to create it. This will result in a price disparity between company X and company Y, with company Y’s products being more competitively priced. This difference in price can result in company Y selling two or three times more than company X and making more profits than company X, despite company X having a higher markup on their products.

Articles

Deciding the markup percentage is a complicated step and depends on a variety of factors like the manufacturing/sourcing price, product quality, and competition. Markup and margin are common accounting terms that are often used when pricing your products. At the start of this article, I mentioned that confusing between margin and markup can be hurtful for your business. However, company X places a 50% markup on the product, while company Y places a 30% markup on the product. One of the greatest advantages of using markup as a basis for your product pricing is that it guarantees that your business generates a proportional amount of revenue for each sale. Setting the right price for your products is very crucial, and can be the difference between attracting customers by the loads and your business going under. Using the above two formulas, we can accurately predict how margin and markup interact with each other.

Markup is one of the most important calculations you can do as a small business and is essential for calculating initial pricing levels on any product or service your business offers. If your contractor has a daily charge rate of $200.00 and your business requires a minimum of a 15% margin to make a profit; your client daily charge rate is then equal to $235.30. As you can see, the markup is a crucial figure in your recruitment business calculations as this number determines your actual charge rate. Having a markup that is too high can result in a loss of clients. The difference between the two is what will impact your business profits. To really mean ‘gross margin’, particularly in the contracting and recruitment industry.

What Is Cvp In A Company?

Markup is the amount by which the cost of a product is increased in order to derive the selling price. To use the preceding example, a markup of $30 from the $70 cost yields the $100 price. Or, stated as a percentage, the markup percentage is 42.9% . Thus, if a retailer wants its income statement to show a gross profit that is 20% of sales, the retailer must mark up its products’ costs by 25%.

- Based on these calculations, she determines that to sell her bags at a 150% markup, she must price them at $37.50.

- Setting the right price for your products is very crucial, and can be the difference between attracting customers by the loads and your business going under.

- Is there a formula for calculating the markup % to ga in a given margin.

- When setting the price, you should also keep in mind that there are several other factors other than the cost of making the product that will affect the price.

- If your contractor has a daily charge rate of $200.00 and your company markup is 15%.

- Is there a formula were you can get a higher percentage of accuracy in your gross profit if you have different mark up?

Your margin is the difference between your selling price and the money you have to spend to create your product. The margin is worked out as a percentage of your selling price. Above, the contractor wanted a margin of 35 percent, then used the reciprocal of that margin to determine the sales price.

Because the markup you use determines your sales price, it’s an incredibly important figure. Without a proper understanding of a markup, home tech pros won’t be able to give well-educated estimates and may be bidding on projects while missing an opportunity to increase their profits. Markup is necessary to ensure that your business is making profits and covering all the costs.

Although most people understand this in principle, accounting terms can be more difficult to grasp. Markups and gross margins can sometimes be used interchangeably, when they are in fact, two very different concepts. Economists have shown that the largest firms in a retail market usually have the highest gross margins because economies of scale allow them to do business at a lower marginal cost. Typically, companies find expressing markup as a percentage of price has greater use-value than a dollar amount. Percentages can more easily be compared to other financial data, such as sales results for the previous year, price drops, and competitor data. BlueCart is a comprehensive eCommerce software solution for wholesalers, small businesses, dropshippers, and hospitality establishments. We offer a complete set of tools including unlimited digital catalogs, shipping and delivery route management, integrated payment processing, and SEO-ready digital storefronts.

Apps To Prepare Your Business For Success In 2018

However, at any point in time, markup is always greater than gross margin, and hence it overstates the firm’s profitability. Due to this reason, markup is most often preferred as a reporting mechanism by the sales and operations department. Any person with a non-financial background will look like a transaction is obtaining a larger profit if they are presented with Markup numbers than corresponding Margin numbers. The markup calculation is more likely to impact pricing changes over time than a margin-based price. It is since the cost upon which the markup number is based may differ with time, or its calculation may vary, resulting in different costs, leading to different prices. Bottom LineThe bottom line refers to the net earnings or profit a company generates from its business operations in a particular accounting period that appears at the end of the income statement.

How To Markup Products

Then, divide that total ($50) by your COGS ($150) to get 0.33. Then, divide that total ($50) by your revenue ($200) to get 0.25.

” Markup and the margin definition are two of the most important numbers that a business owner or manager needs to know. Know the difference between a markup and a margin to set goals. If you know how much profit you want to make, you can set your prices accordingly using the margin vs. markup formulas. The margin formula measures how much of every dollar in revenue you keep after paying expenses. The greater the margin, the greater the percentage of revenue you keep when you make a sale.